9 Reasons Why $DWAC and TRUTH Social Are Disasters Waiting To Happen

This should be self-evident, but judging by market activity and WallStreetBets chatter, it’s not. The merger between Trump Media and Technology Company (“TMTC”) and Digital World Asset Corporation ($DWAC) is a disaster waiting to happen. Yes, even for Trump himself. Sure, he may line his pockets in the short term, flush with retail investor cash, but it’s only a matter of time before he faces a parade of securities fraud litigation. And that’s the best case scenario. Given his historic difficulties with the truth, civil lawsuits may be the least of his concerns should he take control of a publicly traded company.

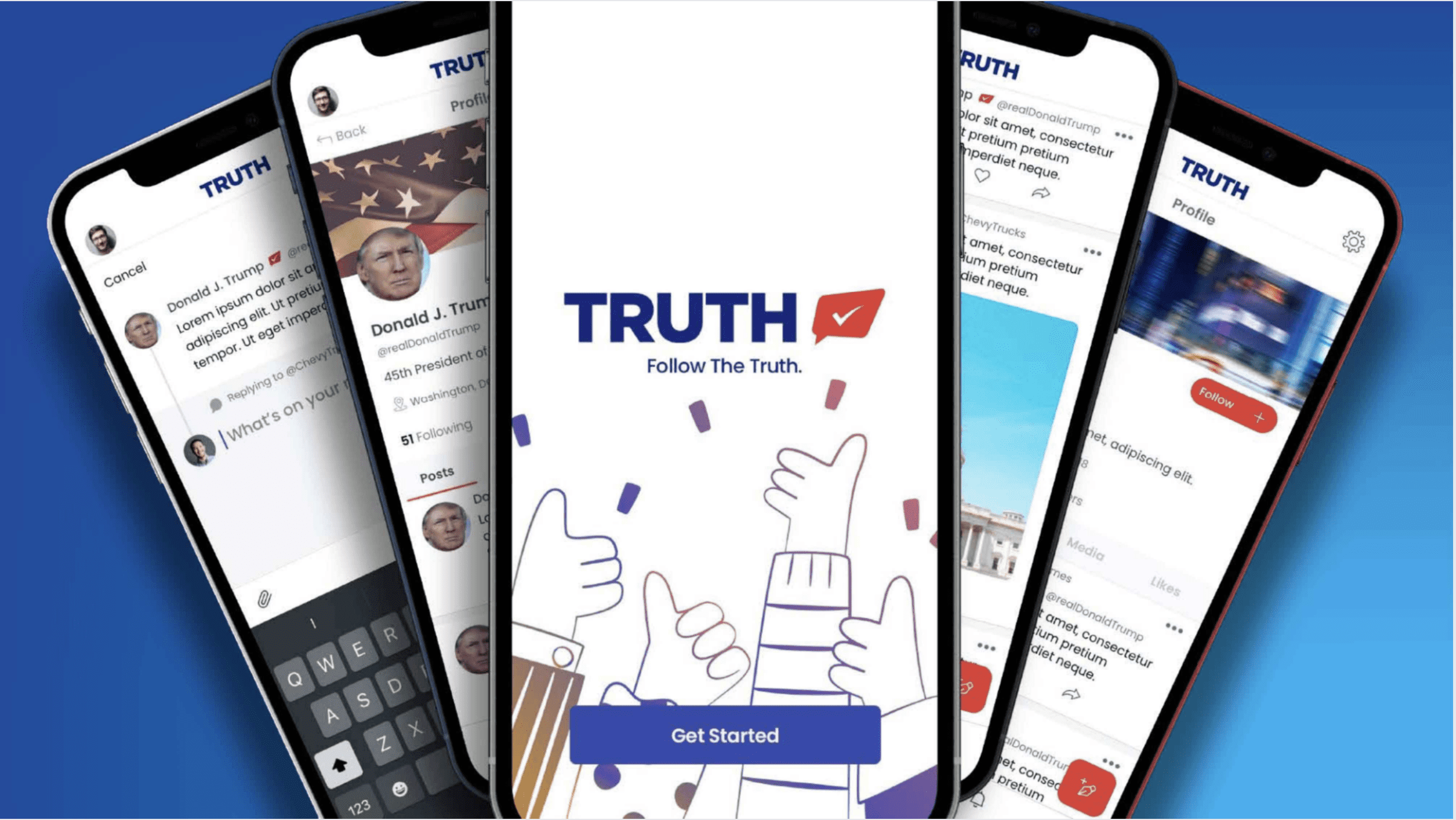

Here are 9 things to consider before investing in $DWAC or joining TRUTH Social, which Trump created “to stand up to the tyranny of Big Tech.”

1. The $DWAC Merger Is Not Final

As of this writing, the TMTC and $DWAC merger has only been announced. While unlikely, there’s a chance the actual closing of the merger does not happen. Trump is no stranger to controversy, which plays differently in capital markets than it does in politics. Should the deal fail to materialize, with $DWAC unable to complete a business combination, shareholders would only be entitled to their pro rata share of “the aggregate amount then on deposit in the trust account.”

What this means is that shareholders who purchased shares on the open market above the IPO price of approximately $9.84 per share would only be entitled to $9.84 pro rata, not the market price they paid. Unless you plan to speculate on $DWAC’s short term price volatility, this isn’t a stock to hold if you think there’s a chance the merger doesn’t close. Speaking of volatility, here’s a snapshot of the price action from the past 5 days. For reference, the DOW was up approximately 0.36% during that time.

2. Trump’s Last Foray Into Public Markets Went Bankrupt Within a Decade

Potential investors in $DWAC and users of TRUTH Social: beware. If history is an indicator (and it often is), not only is this stock headed for the toilet, but the social media platform (which isn’t even built yet) is only for the enrichment of one person: Donald Trump.

Allow me to take you back to June 7, 1995, the day Trump Hotels and Casino Resorts went public at $14 per share. At a time when other hospitality and casino stocks soared, Trump’s stock (ticker: DJT) sank.

“A shareholder who bought $100 of DJT shares in 1995 could sell them for about $4 in 2005. The same investment in MGM Resorts would have increased in value to about $600.”

DJT, the narcissistic acronym for Trump Hotels and Casino Resorts, was bankrupt by 2004, less than a decade after going public. It should surprise no one that Trump used that public company for rampant self dealing – from entertaining at other Trump properties and using Trump planes, to leasing space at Trump Tower, Trump acted in all ways except in the best interests of shareholders. He used DJT as a personal piggy bank. There is no reason to think he will act any differently with $DWAC.

3. The Trump Media and Technology Company Literally Has No Business Plan

All one has to do is look at the “Company Overview.” Most SPACs like $DWAC lack fundamentals because they have no revenues or earnings to date. But most will at least provide some type of forecast for investors. When describing Trump’s “Company Overview”, Bloomberg’s Matt Levine observed, “There is no financial analysis, no sources and uses of funds for the deal, no capital structure, and certainly no projections for future revenue.”

I mean, the “Company Overview” is filled with slides like this, after all:

If that doesn’t convince you to invest in $DWAC, I’m not sure what will. Maybe this slide?

Now that’s the type of substantive financial analysis I’m talking about! In all seriousness though, nobody in their right mind will buy this stock on economic fundamentals alone. It is purely based on one thing – your belief in Donald Trump, or at a minimum, your belief that many other people believe in him. If you have come looking for cash flows, valuation, or even a basic business plan, you have come to the wrong place.

4. Bring On the Short Sellers

With the nonexistence of any business plan or financial projections, not to mention the visceral reaction many have to all things Trump, expect a healthy dose of short selling on $DWAC. This is especially true if the stock remains at current levels, with more WSBettors bragging about their returns like this guy and this guy.

Market participants are already lining up to short $DWAC now that the initial hype has passed. Iceberg Research, for example, said in recent tweets the following:

Even Trump loyalists are not planning to follow him into capital markets. As this investor said,

“While I support Donald Trump and have confidence in his abilities, I am less certain that his brand will translate into stock-market successes at this stage.”

There will also likely be more retail investors like this “middle-aged dad” who wants to “screw the MAGA army” with puts or other shorts on $DWAC. Bring on the short sellers.

5. TRUTH Social Is Already In Violation of the Law

If those first four considerations are not enough, everyone should appreciate that TRUTH Social (where you can send out “TRUTHS” in lieu of “Tweets”) is already in violation of licensing requirements. The site is being built (yes, still not complete) with open-source software Mastodon.

Mastodon’s license requires anyone using its platform to open its code to users. TRUTH Social represents its software as “proprietary” despite the fact it runs on Mastodon. Unless that changes in the next month, TRUTH Social may already have a civil lawsuit on its hands.

6. TRUTH Social Handles Your Data Much Like “Tyrannical” Big Tech Companies

Despite Trump’s rants against “Tyrannical Big Tech companies”, TRUTH Social appears to play by similar “tyrannical” rules. Users of TRUTH Social are first greeted with this under the site’s “Terms of Service”:

“PLEASE READ SECTIONS 17 AND 18 BELOW CAREFULLY AS THEY CONTAIN A BINDING ARBITRATION AGREEMENT AND A CLASS ACTION WAIVER, WHICH MAY AFFECT YOUR LEGAL RIGHTS.”

This significantly curtails the rights of anyone using the site and is a common clause found on most social media platforms (although it may not always be enforceable).

Furthermore, the Privacy Policy talks about all the ways in which Trump and co. will or “may” use your data. Here are some highlights, which all sound standard “tyrannical big tech”:

We may also collect location information from devices you use while accessing the Site.

We may use your User Registration Data and other information or data we receive or collect, as well as data we derive or infer from combinations of the foregoing, for a variety of purposes

We may also work with data partners and advertising platforms to help increase the relevance of ads we provide to you.

We use cookies and the identifier in these cookies to help us manage and report on your interaction with the Site.

We may share information we collect with our subsidiaries, successors or related companies for the purposes described in our respective privacy policies, and to offer, provide, and improve services and products offered both individually and jointly with these companies.

We may also share information if we partner with a third party to provide services on our behalf

At least you can always email support@truthsocial.com or call (866) 878-8442 if you have questions on the Privacy Policy.

7. Barriers To Competing with “Tyrannical” Big Tech Companies

Social media companies are not born out of the blue everyday for one good reason: barriers to entry are high. Companies like Facebook and Twitter have high market caps (approximately $886 billion and $44 billion, respectively). $DWAC, on the other hand, will have approximately $293 million at its disposal post merger.

In addition, while most social media companies did not turn profits prior to going public, they had solid foundations in terms of technology and a dedicated user base. TRUTH Social has neither. The platform is not even final.

Although there is value in having Trump’s “MAGAphone” on the new platform, it will still have to compete with existing conservative media platforms like Parler, Rumble, and Gab. Also, other conservative news sites like Fox News will not simply step to the side and let all eyeballs go to TRUTH Social. So while Trump can paint a pie in the sky in his Company Overview, as depicted below, the “truth” of the competitive structure is a different story.

8. Who Will Advertise?

I say this, but temper it with the fact that the horrific events from January 6th did not dissuade many corporations from donating to Republican candidates who increasingly shirk blame or responsibility for what happened (whether for themselves, the GOP, or Trump).

In order for TRUTH Social (and other TMTG properties) to compete, it will need advertisers. Lots of them. While Trump can probably rely on the likes of MyPillow, it’s unclear how many corporations will be willing to support social media that includes xenophobia, racist dog-whistling, and general anti-democratic (some might even say facist) rhetoric.

If Trump can bring the eyeballs, he should not have a problem finding advertisers. If the masses start voting more with their dollar, however, that could pressure some of these corporate donors.

9. Legal Uncertainty Should Trump Run and/or Be Elected President In 2024

No candidate or sitting U.S. President has ever owned a media conglomerate. Many who did own businesses completely stepped away from them. Trump did not even go to those lengths in 2016 when he was elected, keeping control of the Trump Organization within the family.

If he were to control a public company and run or be elected President, that would create a web of conflicts and legal issues, many of which he may try to ignore. It is something to consider though if you choose to invest in $DWAC based on your belief in the man himself. If that man is removed from the equation, what happens to the company? It’s unlikely to attract the same attention and therefore advertising revenue. With that said, he would undoubtedly insert a loyalist Chairman and CEO and maintain an undying presence on TRUTH Social.

Conclusion

All of this should serve as a warning, particularly to retail investors looking to ride the WallStreetBets and meme stock wave with $DWAC. Given Trump’s turbulent past in public markets, investors should tread cautiously both in the short and long term.

Unlike in the political realm, every bad thing a public company or public company executive does has consequences. Securities fraud does not operate in a world of alternative facts or fake news. As Trump experienced following the election, where he went 1 for 62 in the courtroom (with the one win being inconsequential to the outcome), courts of law operate in reality. Should Trump run $DWAC in a similar way to his presidency, he may invite more securities fraud lawsuits – both against himself and the company – than any public company in history.

As with the short sellers, his company will be a target for enterprising and litigation hungry lawyers. That goes for TRUTH Social as well. Hackers like Anonymous will also relish the opportunity to disrupt the platform. Moreover, the lack of a business plan and adequate technology – not to mention governance and controls – will make it next to impossible for the company to operate and compete in an incredibly competitive arena.

If there is one “TRUTH” in it all, it’s that Trump will find a way to enrich himself. I just hope the Orwellian name for the network is not a sign of what’s to come.