Where Is Jho Low, the Billion Dollar Whale?

Some people have the worldview that because others lie, cheat, and steal, they can too. This perverse form of moral relativism describes Jho Low, the real life antihero of a book I read recently, Billion Dollar Whale. Jho Low makes Bernie Madoff sound like a junior varsity fraudster. Madoff’s fraud may have led to losses in excess of $18 billion, but his take was a fraction of it. His scheme’s “profits” had to be shared across investors in order to keep his Ponzi Scheme thriving. Low, however, simply took hundreds of millions of dollars. So long as he maintained control of 1Malyasia Development Berhad (1MDB), whether directly or through a network of proxies, he could continue to pilfer funds intended for the benefit of the Malaysian people.

The book does a great job of breaking down the scheme and all of its players. Chief among them was former Malaysian Prime Minister Najib Razak. He was recently found guilty on a myriad of charges, including abuse of power, breach of trust, and money laundering. He faces up to 12 years in prison, and awaits potential sentencing on other related charges. Without Razak’s protection and support, Low never would have been able to loot 1MDB’s coffers.

Quid Pro Low

Najib Razak had designed the sovereign wealth fund supposedly to benefit the Malaysian people. It was structured to invest in green energy and tourism, with the idea it would create high quality jobs. At best, Razak acted with willful blindness by handing the keys to the fund over to Low, especially after hearing about Low’s extreme playboy lifestyle. Jho Low bought more than $1.7 billion in real estate, yachts, jets, jewelry, and he even financed a Hollywood movie (The Wolf of Wall Street, ironically) with the money he plundered.

“This is a fucking scam – anybody who does this has stolen money. You wouldn’t spend money you worked for like that.”

– Jordan Belfort

In reality, Razak was an accomplice to the crimes, with about $1 billion ending up in his personal bank accounts. When Razak later used 1MDB as a political-financing vehicle, he directly tied his future to his friendly fraudster, Jho Low. With that said, Razak could still win on appeal and escape justice. He is still a senior member of the current political party in power in Malaysia, UMNO.

Prosecutors were more lenient on Razak’s stepson, Riza Aziz, who produced The Wolf of Wall Street. He helped organize the film’s premiere, where troves of A-list celebrities partied in opulence. Among them was Leonardo DiCaprio, a frequent member of Low’s entourage. Despite Aziz’s film studio having no real films under its belt and the fact The Wolf of Wall Street was still awaiting production, they threw a multi-million dollar party that was over the top even by Hollywood standards. The book quotes an astonished Jordan Belfort, the fraudster who inspired the movie itself. He declared: “This is a fucking scam – anybody who does this has stolen money. You wouldn’t spend money you worked for like that.” Riza was allowed to walk away with some $83 million (after returning other assets to the Malaysian government).

Gold from Goldman and Cover from China

Jho Low’s heist also was made possible by Goldman Sachs. Low needed access to debt capital markets in order to raise hundreds of millions of dollars for the fund, and ultimately, himself. For their part, Goldman has attempted to shift the blame to “rogue actors” like Tim Leissner, Roger Ng, and Andrea Vella. The book details the firm’s control failures and how senior management turned a blind eye while Goldman reaped the benefit of $600 million in fees from multiple bond deals (fees that are astronomically higher when compared to similar transactions in the Asia region). The Malaysian government recently reached a $3.9 billion settlement with Goldman. The firm and its executives escaped criminal liability.

So where does a guy go after stealing billions of dollars from a country’s sovereign wealth fund? China. Especially when Americans are chasing you. The Inspector General of Police in Malaysia recently said that Low conducted several business transactions in Macau. He claimed that local authorities have not cooperated. China denies they are harboring the fugitive financier.

Billion Dollar Whale was published in 2018. Since the book went to press, figures like Razak were arrested, and firms like Goldman have faced scrutiny. The one constant, however, has been Jho Low, a man who is still on the run. His story reveals how fraudsters and criminal masterminds are only able to execute schemes and escape justice with help from enablers. The key players may have been those mentioned above – Razak, Aziz, Goldman Sachs, and now potentially China – but numerous others supported Low along the way, as expertly detailed by this book.

Low even tried to squash the book’s publication. He used a London law firm to orchestrate a public relations campaign to block its distribution. Booksellers across the globe received threatening letters, but thankfully free speech won the day. Unless a book is unequivocally libelous, it is hard to imagine a justifiable reason for banning its distribution and sale (even if it’s filled with obscenity and hate). But that is another topic for another day.

The Take on Billion Dollar Whale

From Hollywood to Manhattan night clubs, the book takes its readers on a thrill ride; one that will leave you gobsmacked at Low’s unabashedly bold displays of wealth. While he celebrated, he was robbing the Malaysian people in broad daylight. The book pulls back the curtain on the ugly corners of global capital markets and capitalism generally. Low has an uncanny ability to pull the levers of power and convince people of his value. Numerous powerful people and celebrities fell prey, from Leonardo DiCaprio, Swizz Beats, and Paris Hilton, to Goldman Sachs bankers. Everyone has their price. Even Chris Christie is reaping the Low rewards by currently representing the international fugitive in a variety of forfeiture actions. The book does a good job at shedding light on the inner psychology of these people. They must have rationalized: “why raise alarms when we stand to benefit”?

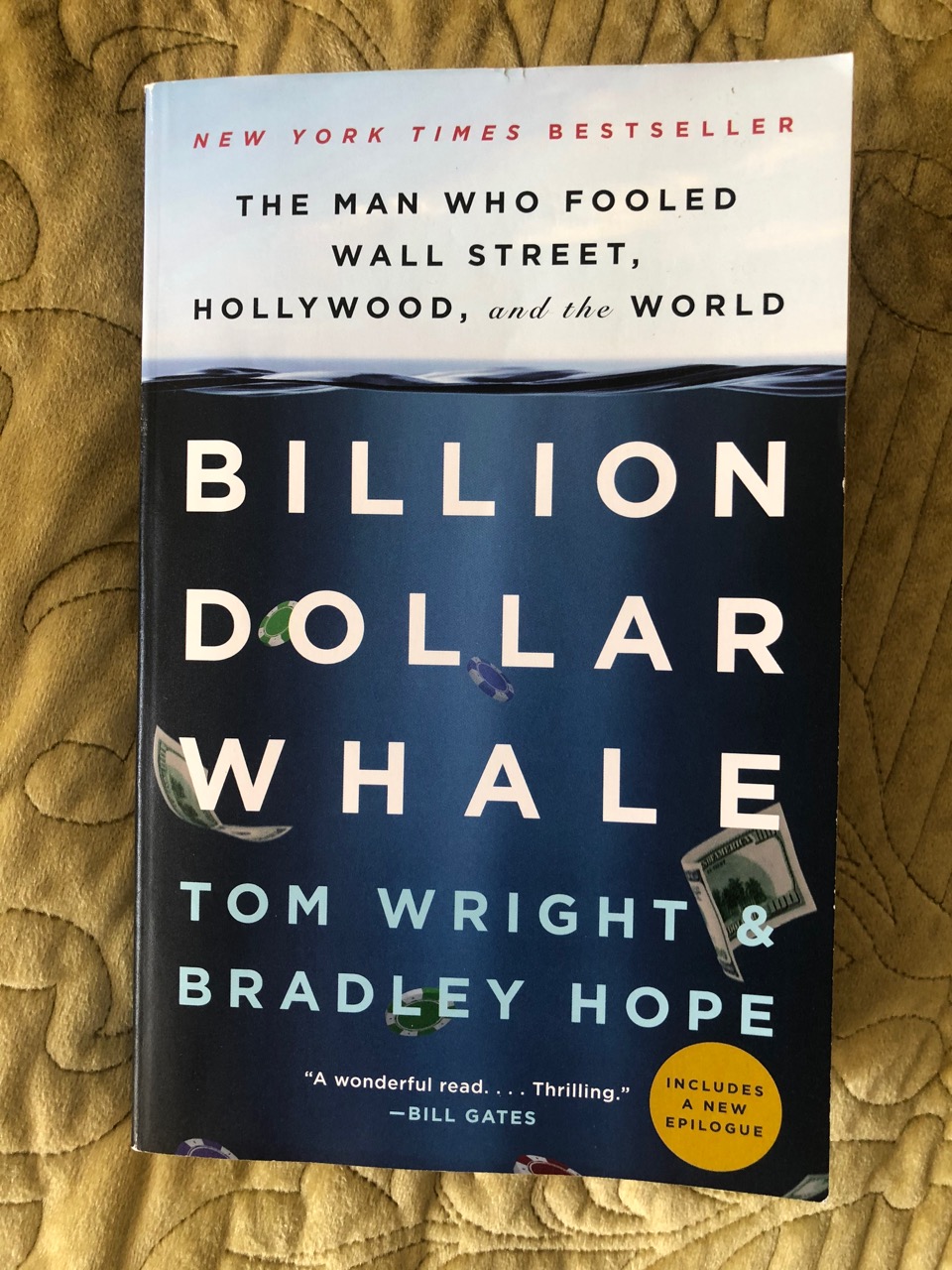

In conclusion, the book is an easy and entertaining read by Wall Street Journal investigative journalists, Tom Wright and Bradley Hope. It will shock and awe that a fraud of this scale could take place in 21st century international markets. Yet if you were like Low and grew up in the developing world, perhaps you too would construct a worldview that seeks to legitimize illegal and unethical behavior because others engage in it. Which is why the current Razak case in Malaysia is so important. Not many former heads of state in the region are held to account for abuses of power, permitting many to act with impunity. Razak’s conviction and the pursuit of justice against Low will go a long way toward restoring and building trust in democratic institutions and ultimately, the rule of law in the region.

But the world should not forget that none of this would have been possible without either consent or willful blindness from scores of executives across the international financial system. Jho Low may have exposed some of the corrupt corners of the financial world. We should not forget, however, that many executives were willing to aid and abet his actions for the right price.

1 Comment

Dark Towers Review - Timely Insights on Who Owns Donald J. Trump · June 8, 2021 at 12:23 pm

[…] There are a number of problem childs, as illustrated in another book I recently reviewed, Billion Dollar Whale (which describes Goldman Sachs’ disastrous dealings with 1MDB, the Malaysian sovereign wealth […]

Comments are closed.