Kevin O’Leary Must Return His FTX Money

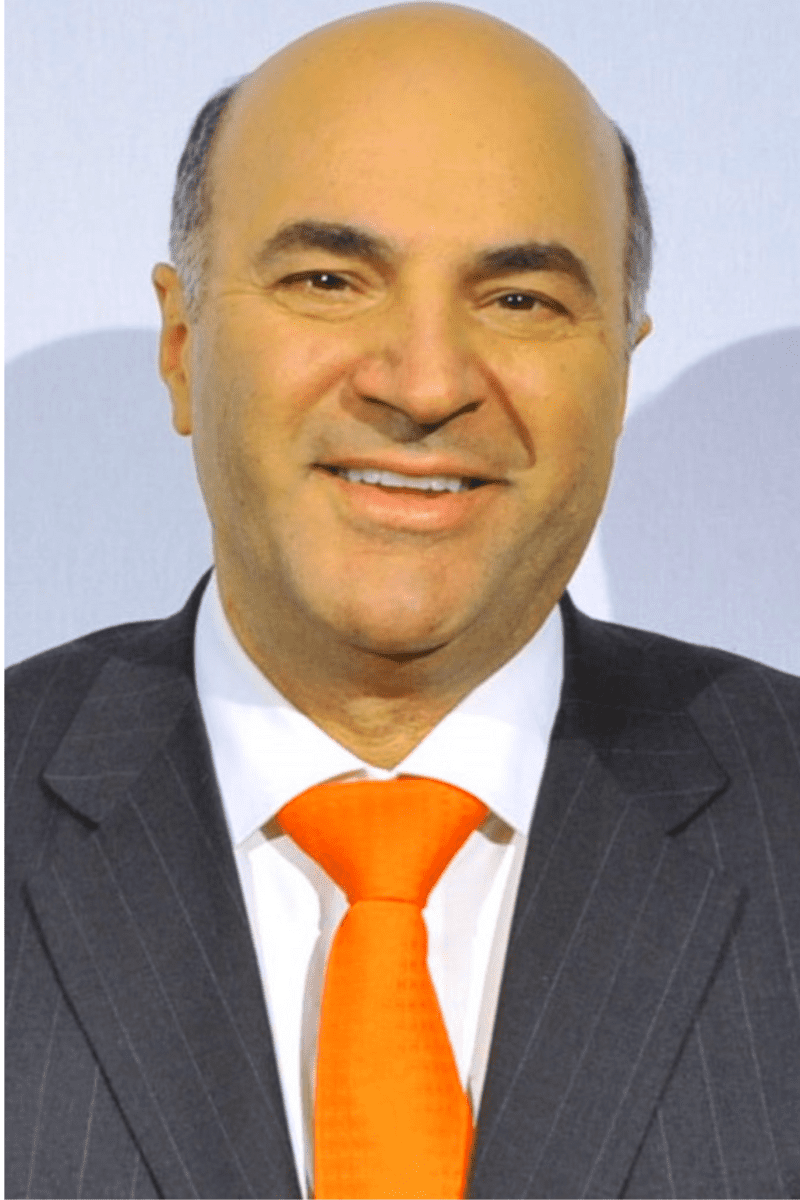

Kevin O’Leary, investor and judge on Shark Tank, was paid $15 million to act as a spokesman for FTX. He was one of many celebrities and influencers who helped advertise for the now bankrupt crypto exchange.

But O’Leary is different from other FTX spokesmen.

Many of them were celebrities or athletes with no connection to finance. If Tom Brady was offering football advice or Larry David was offering comedic advice, I would be holding them to a higher standard. When they try to sell a crypto exchange, some people may be convinced by their starpower, but most recognize the pure celebrity nature of it.

A guy like Kevin O’Leary, on the other hand, bills himself as a finance guru. He has a large social media presence where talks about everything from macroeconomics to entrepreneurship and personal finance. O’Leary is also a regular contributor on CNBC and a host of the popular show Shark Tank.

He makes it known how rich he is. Latest valuations put his net worth around $400 million. He may not be the richest shark in the tank (that prize goes to Mark Cuban), but he does well.

When people see someone like Kevin O’Leary promoting a crypto exchange like FTX, they naturally place more weight on his endorsement. Assuming they know him, of course. It’s reasonable to expect that a guy like O’Leary has done some level of due diligence prior to promoting the product. It’s also reasonable to expect he understands the basic finances and business model of the company he’s promoting.

Kevin O’Leary thinks FTX is good, so it must be safe to trade crypto there!

Pay up, Kevin

When Kevin has been asked about the $15 million he made on the FTX promotional deal, he’s given a number of vague answers as to what happened with the money. He has said that he lost it all by investing it in FTX. He’s also said he had to pay taxes and agents from that money.

I don’t believe anything he’s saying.

I highly doubt a spokesperson like O’Leary would take their entire payment from a promotional deal and sink all of it back into the company that paid him. He may have had separate investments in FTX or its native token, FTT. But he didn’t spend all $15 million on FTX.

The reason I am hyper-focused on the $15 million is because it’s likely stolen money. Based on current facts, it appears Sam Bankman-Fried crossed the rubicon by sending customer funds to his own market maker and hedge fund, Alameda Research. He also sent billions to Binance to buy them out in the months prior to the FTX collapse, but that’s a story for another day.

Unless O’Leary can demonstrate he actually lost all $15 million in the FTX collapse, he should be required to forfeit that money in the FTX bankruptcy. He was at a minimum negligent in agreeing to be a FTX spokesperson even though he did little to no diligence. His overall “finance guru” persona requires that we hold him to a much higher standard than the likes of Tom Brady.

If clawbacks were permitted in the Madoff case, they should apply here too. That means anyone unjustly enriched with stolen money has to give it back.

Pay it up, Kevin.

Do not let Kevin on the creditor committee

In bankruptcy proceedings, it’s common for the bankruptcy trustee to organize a creditors committee. Anyone on the committee is responsible for overseeing how available assets are distributed to unsecured creditors (i.e., generally those with smaller amounts that were lost). They have a fiduciary duty, or obligation to act in the best interests of, any of these creditors in the bankruptcy proceeding.

Kevin O’Leary has said that he applied to be on this committee. I have not heard one interview host or Congressman (he recently testified on Capitol Hill) press him on the fact that he would be terribly conflicted if allowed on the committee. Not only was he paid to promote FTX, he’s also trying to line up as a creditor himself.

I doubt any bankruptcy trustee would let him on the committee, but crazier things have happened. Given his past advocacy for FTX, he should be prohibited from going anywhere near the creditor committee.

How do we know he’s still not trying to save face and minimize what happened at FTX?

We don’t.

Regulators and law enforcement need to step up efforts against crypto influencers

The U.S. Department of Justice recently took action against eight social media influencers for a securities fraud scheme, but more needs to be done to police crypto promotion. Influencers like Kim K have been fined for failure to disclose certain partnerships, but regulators like the U.S. Securities and Exchange Commission need to step up efforts on false and misleading claims too.

They should also consider requiring some basic due diligence before celebrities and influencers can sign up to promote crypto or other risky financial products. As we witnessed with FTX, caveat emptor – or buyer beware – is not sufficient. People need greater protection against themselves.

And while U.S. authorities acted incredibly fast in indicting Sam Bankman-Fried, they need to be doing more than simply putting out video content like this:

It’s helpful, I guess, but swift action against influencers hyping random esoteric crypto tokens or coins is even better.

Everyone from Tom Brady to Kevin O’Leary needs to be put on notice that if they want to use their celebrity or guru status to promote financial products, there’s risk for them if they’re wrong.

Maybe that risk should include prison time next door to Sam Bankman-Fried.

At a minimum, it should include Kim K-type fines and clawbacks if they were paid with stolen money. With the creator and influencer economy growing by the day, we need baseline promotional rules in place, especially for those who claim to be experts like Kevin O’Leary.